Reinventing your business during a crisis

Even if your resources are limited, you may emerge stronger and better to rebuild your business during a crisis and propel it ahead.

Reinvention occurs on a regular basis. Many firms are reinventing their business during a crisis to reflect current consumer trends, while others are undergoing complete transformations, from the way they operate to how they service customers. The reality of our environment is that change forces us to reinvent and transform ourselves on a regular basis. If you choose to remain stationary, you risk losing your significance.

But what if we’re in the midst of an economic crisis? Isn’t it impossible to alter a firm at such a risky time? Organizations are at a fork in the road due to significant resource restrictions. On the one hand, they are aware that the longer they remain stationary, the worse things will become for their company. On the other hand, despite it putting a drain on resources, reinventing your organization is the only way to ensure its survival.

How a business reinvents itself during a crisis is critical, as it determines whether it will be able to weather the current storm and survive. This is why reinventing your business and transforming your people are so important. Although transformation is not an overnight process, it must begin at some point, and now is the moment to do so.

Here are some tips to help you reinvent your business:

1. Everything stems from the people, the business’s beating heart.

The first step is to determine where your people stand in relation to the current problem. Everyone reacts to change in their own unique way. Keep in mind that other elements such as the existing manner of working, the organization’s processes, and, of course, personal events might have an impact on your employees.

At this juncture, your employees’ mindsets, resilience, learning, and agility are critical. These characteristics constitute the cornerstone of development, and while some are innate, they may be cultivated in everyone. We will be doomed to fail if we do not build these foundations. While agility and resilience are important, encouraging people to learn helps them stay alert and prepared to face new difficulties. So take this in mind when you are facing a crisis where you need to reinvent your business.

2. Examine your company’s current state in regard to its clients.

At this point, a good question to consider is: Are my products and services meeting my customers’ changing needs? While the answer may be “no” for some, even those who say “yes” may face difficulties. This is because, in a crisis, people’s behavior — and, with it, their consumption behavior — alters, as we’ve witnessed during the ongoing Covid pandemic. You might need to consider changing your products or service when you reinvent your business during a crisis.

3. Define focus with insights from employees and clients.

There are numerous strategies to reinvent your business during a crisis in order to retain your employees and meet customer demands. Adjusting the business model, switching to alternative products, or changing the way you serve consumers are all examples of this. This is a critical initial step in the process of revamping your company.

However, we cannot really attain everything we desire for our businesses. We need to refocus on a few focus points and accomplish them well while resources are tight.

4. Set short- and long-term objectives.

We can define the goals after we’ve defined our focus. The most effective means to track our progress toward those goals. When reinventing your business during a crisis, the most important goal is to get out of it as quickly as possible. Long-term goals, on the other hand, are critical for the business’s long-term viability.

It is also critical to design and implement a recovery plan at this time. This should include a strategy and specific actions for resuming operations as quickly as possible. The situation will not persist indefinitely. When it’s over, businesses must be prepared to ensure that the competition does not gain the upper hand.

Take all of the lessons acquired from the crisis as well. Apply what you’ve learned to your company’s future strategy and culture. Today, for example, must be the first day of embracing agility as a key component of its culture.

5. Finally, and most critically, reallocate resources to maximize efficiency.

While it’s admirable to want to seek out fresh chances and seize them, this may not be feasible. This is owing to the fact that you are working with restricted resources as a result of the crisis. You must also reinvent your people to focus on the goals at hand, a process known as reorganization.

Change is difficult for everyone, let alone an business with a large number of people to manage. Change, on the other hand, provides us with the opportunity to pursue something even greater and better than before.

A crisis can be destructive, but it cannot last indefinitely. The most essential thing is to make sure you’re ready to bounce back stronger and better than before when the crisis passes.

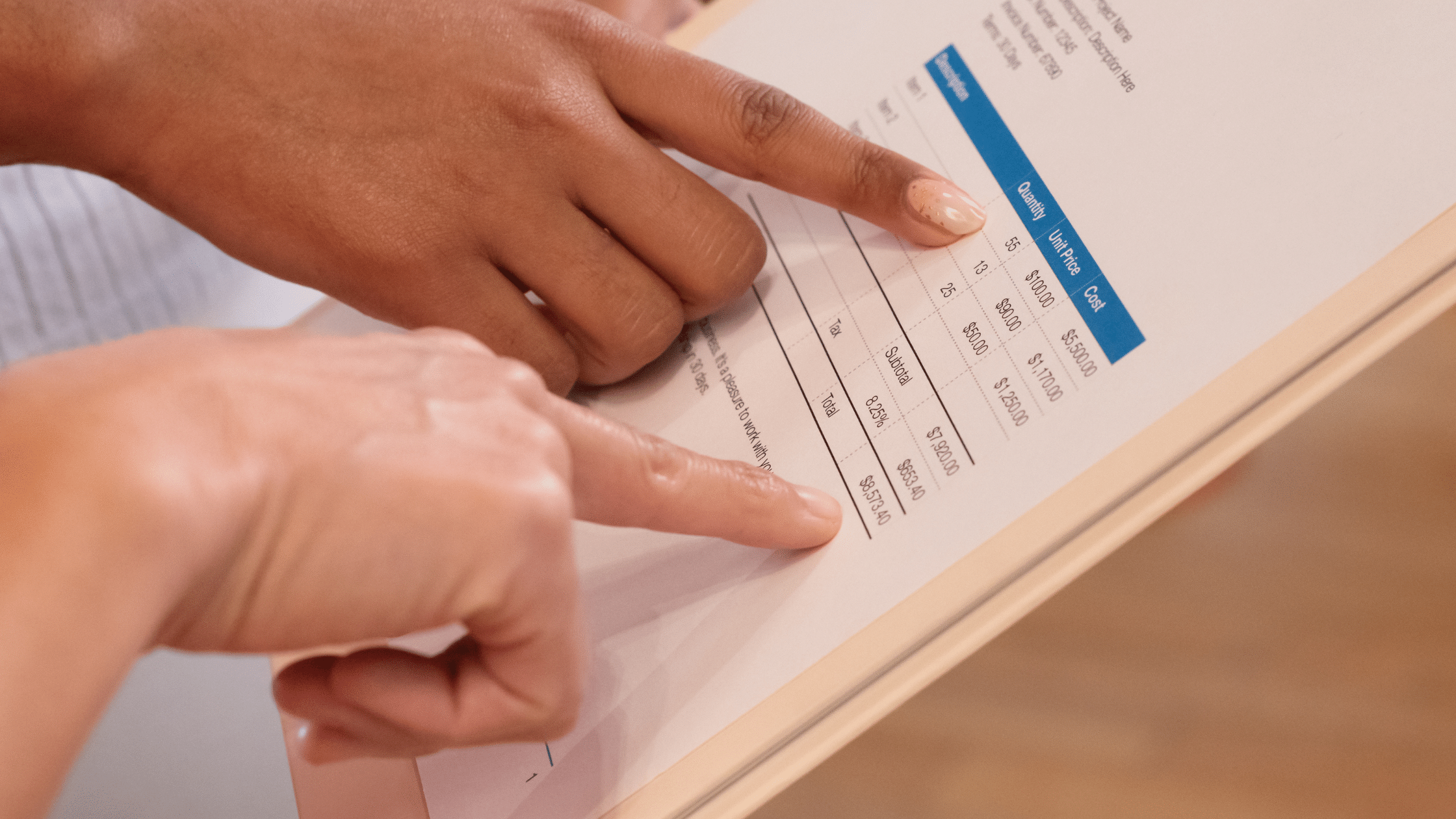

Conclusion

One way you can reinvent your business is to reduce employee overhead by outsourcing the highly technical aspect of your business -like bookkeeping- to industry professionals. Doing so helps you get far more control of your business finances and it helps you see a clearer picture of your business’ financial health. Lucky for you FAS is in the business of helping small businesses! Send us a message and we’ll discuss how we can help you see your business’ financial health clearer.