2022 Tax Filing Season in Peril of Delays

2022 Tax filing season is in peril of delays because the Internal Revenue Service has not yet processed more than 24 million tax returns from last year, a large increase from the number reported by the agency. The IRS also said it is taking many taxpayers far longer than usual to get their refunds.

The Situation

The IRS’s taxpayer advocate service delivered a report to the tax-writing committees in Congress. The inventory lists unprocessed returns and related correspondence. The agency’s warning that it would provide poor service in the 2022 filing season is nothing new; this has been the case for years.

The IRS’s taxpayer advocate service delivered a report to the tax-writing committees in Congress. The inventory lists unprocessed returns and related correspondence. The agency’s warning that it would provide poor service in the 2022 filing season is nothing new; this has been the case for years.

Three people who spoke on the condition of anonymity because they were not approved to speak publicly say that the IRS is struggling to hire and train new staff, and respond to growing bipartisan pressure from lawmakers and tax preparers to clear the logjam and provide relief to taxpayers. Among the considerations are suspending tax collections and excusing some penalty enforcement.

30 Senators wrote to Treasury Secretary Janet Yellen and IRS Commissioner Charles Rettig on Thursday, saying that a raft of delayed returns, some dating back to the 2019 filing season, along with millions of missed calls and other correspondence had threatened “our constituents’ ability to have their returns processed accurately and efficiently.” However, it can be noted that some Senators are hindering any new federal help that might be able to save the agency from drowning even further.

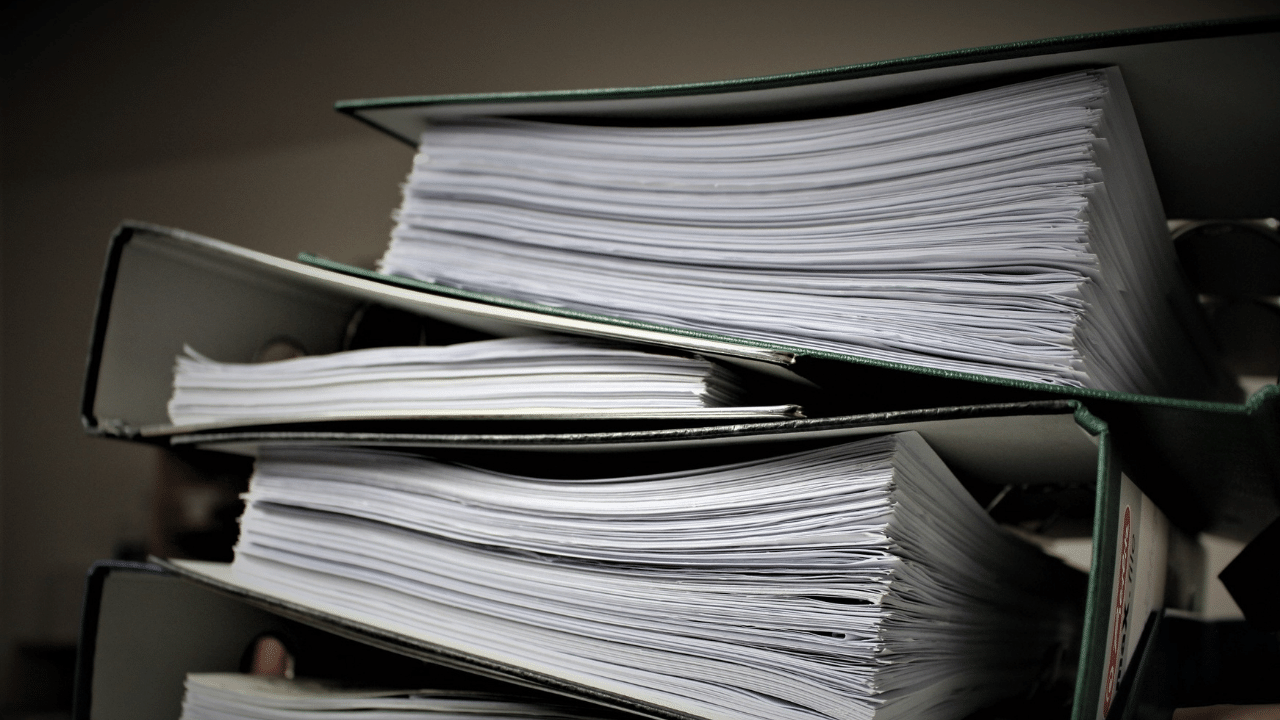

The IRS’s productivity took a big hit during the coronavirus pandemic, with thousands of employees working from home for months without access to returns, audits, and other business. The federal stimulus measures also added to the agency’s workload, as it emphasized getting relief money to millions of Americans. Paper returns took the greatest hit, as mail piled up on trucks outside closed offices for months. Foreboding peril of delay on the 2022 tax filing season.

The storm over hiring continued to intensify on Tuesday after IRS Inspector told lawmakers at a hearing that the agency continues to suffer from severe, long-standing hiring shortages, inefficient practices, and old equipment. That includes mail processing woes since its systems have “outdated dust collectors” that cause paper jams. Poor scanners, meanwhile, meant the IRS last year missed out on $56 million because of “untimely check deposits,” since the agency could not determine if envelopes it received contained checks.

Erin Collins, of the National Taxpayer Advocate, said in January that there was a backlog at the IRS of about 10 million tax returns. An IRS official said that 6 million individual tax returns were unprocessed from the previous filing season. In the past, the IRS typically processed only one million or fewer returns in a season.

But the new data include broader categories of work, such as manufacturing, that have been stagnant since the pandemic, and some positive returns that have come in this year. Taxpayer advocates, lawmakers, and others say the revised count is a more realistic representation of activity.

It does not include returns that are pending because of slowdowns related to enforcement actions, appeals of audits, notices of tax liens, penalties, or other business workflows.

More than 80 percent of taxpayers now file their tax returns electronically, and those can generally be processed quickly. The remaining 10 percent who file Form 1040 on paper should expect a delay in processing any tax return that contains errors.

The IRS is still processing paper returns filed for the 2020 tax year and has only caught up to April 2021 for returns without errors, according to the most recent information available on its website. Last year the vast majority of taxpayers— about 77 percent—received refunds.

IRS Burden

The IRS’s backlog of letters was formed in part by the many demands put on it during the Covid pandemic.

Congress gave the agency the power to send direct relief checks to millions of Americans, giving it immense pressure to act swiftly to help cash-strapped families newly out of work. Multiple rounds of such payments have been approved, and Democrats last March made an even more work-intensive request: to stand up a system that would distribute monthly tax payments to families with young children.

Since the IRS was underfunded and understaffed for decades before it was given new responsibilities, President Biden and top Democrats have proposed boosting the budget, but their effort has so far failed to gain enough support in Congress, where lawmakers are still working on a spending deal to fund the government and avoid a shutdown.

Both parties have said they are confident that the federal government can remain open for the rest of the fiscal year, which ends on September 30.

Rather than funding new IRS initiatives, Some Senators this week called on the agency to consider other tactics that it has previously used to ease the burden on taxpayers. These include halting automated invoice and collection processes until agency staff can sort through piles of unopened mail and better prioritizing which returns it takes.

The senators wrote in their letter, “When taxpayers cannot get help from those tasked with administering our tax laws, it diminishes the integrity of our voluntary tax system.”

The solution

The IRS has already halted collection notices that are triggered when records show a taxpayer owes taxes and has not filed a tax return. Many of these letters have gone out before the returns have been processed. With this they hope that the 2022 tax filing season won’t be in peril of delay.

A Treasury official who spoke on the condition of anonymity to describe private conversations said Rettig said at a Ways and Means Committee meeting in January that the agency is working to get the backlog of unprocessed tax returns back to normal levels by the end of the year.

The commissioner announced last week that he was temporarily reassigning 1,200 employees as part of a “surge team” to help. However, the House Ways and Means Committee oversight panel was told this week that staffing problems are far broader, due in part to recruiting challenges and low pay.

The agency had originally intended to hire 5,000 workers for several campus locations but ended up filling fewer than 200 positions. In a bid to attract talent, the organization is paying employees $500 if they refer job candidates that stay in their roles for at least a year.

The IRS is having issues with its staff. The agency has one of the oldest workforces in the U.S. Treasury Inspector General for Tax Administration reported that as of August 2021, the IRS faced a total staff shortfall in the submission processing unit of about 2,598 employees. The surge Rettig announced is not going to submission processing, but will be staffing a department known as accounts management, which answers the taxpayers’ phone calls and responds to general correspondence.

The watchdog urged the IRS not to close its processing center in Austin, Texas — a planned part of a long-term consolidation as more business is done electronically — until hiring and backlog shortages are addressed, rather than waiting for the agency’s current approaches to improve staffing to bear fruit.

The looming troubles with this filing season led tax preparer groups to form a coalition in recent weeks as part of an effort to pressure the agency for relief.

The executive director of the National Society of Tax Professionals, said groups representing more than 100,000 tax preparers have joined together to help taxpayers with an inventory of unprocessed returns. “There is nobody to help the taxpayer,” said Tross, quoted in the February issue of The Journal of the National Society of Tax Professionals. “What is it going to take to get this outstanding inventory through the system?”

The coalition said it has received complaints from members who claim they have gotten too many automated notices saying they failed to file or failed to pay, when in fact they have or have sent letters back contesting the charges. Members seeking to file power of attorney forms for clients also have gotten nowhere.

Bottomline

The IRS is facing an unprecedented level of backlog coupled with manpower deficiency and roadblocks manned by some Senators which forebods 2022 tax filing season in peril of delays. This level of hardship that the IRS is facing could mean that the tax returns for this year would be delayed, but nothing is for certain yet. The odds might be against the IRS, but they may still be able to come out ahead despite internal and external forces holding their hands back. What does it mean for taxpayers? Delays! Even though the tax preparer groups are doing everything they can to protect the interest of their clients, the ball is still in the hands of the IRS. At this point, all we can do is wait and see if the IRS will come through or if they will drop the ball this tax season.

Don’t want the hassle of taxes dragging you down? Send us a message today and let one of our Enrolled Agents do your taxes for you!

Get in touch with us today!

The IRS’s taxpayer advocate service delivered a report to the tax-writing committees in Congress. The inventory lists unprocessed returns and related correspondence. The agency’s warning that it would provide poor service in the 2022 filing season is nothing new; this has been the case for years.

The IRS’s taxpayer advocate service delivered a report to the tax-writing committees in Congress. The inventory lists unprocessed returns and related correspondence. The agency’s warning that it would provide poor service in the 2022 filing season is nothing new; this has been the case for years.