Here are eight tips to keep in mind when choosing the right tax preparer to help you. For more information, go to: https://goo.gl/tn8KPk

-

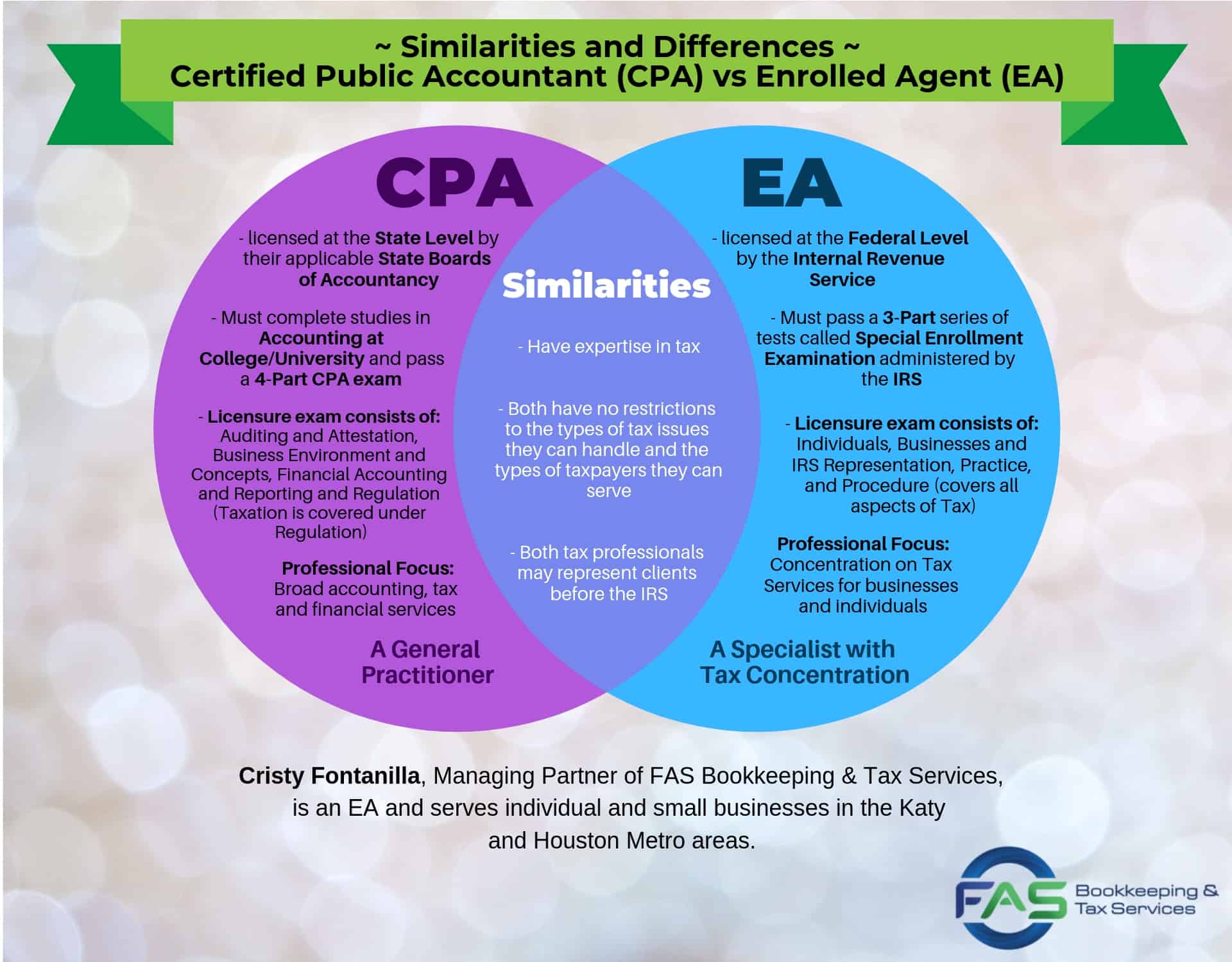

Check the Preparer’s Qualifications.

You can check or visit the IRS Directory of Federal Tax Return Preparers with Credentials and Select Qualifications. This tool helps taxpayers find a tax return preparer with the qualifications that they prefer. The Directory is a searchable and sortable listing of preparers with credentials or filing season qualifications.

-

Check the Preparer’s History.

You can visit the Better Business Bureau about the preparer. Check for disciplinary actions and the license status for credentialed preparers. For CPAs, check with the State Board of Accountancy. For attorneys, check with the State Bar Association. For Enrolled Agents, go to IRS.gov and search for “verify enrolled agent status” or check the Directory.

-

Ask about Service Fees.

The IRS recommends avoiding anyone who bases their fees on a percentage of your refund or who boasts they can get you a bigger refund than their competition.

-

Ask to e-file.

The IRS says you should make sure the preparer offers electronic filing of returns. Generally speaking, any preparer who expects to file more than 10 client returns in a year must use IRS e-file. The agency says choosing both e-file and direct deposit for refunds is the fastest and safest way for taxpayers to both file and get any refund due.

-

Make Sure the Preparer Is Available Even After the Tax Filing.

Avoid fly-by-night preparers. Make sure that the preparer is available and you can contact them after the tax filing.

-

Complete A Tax Organizer and Questionnaire

A good preparer will provide a tax organizer for the taxpayer to complete and provide necessary information. They will ask questions to support the total income, deduction, credits, and other items that need to be completed on the tax return.

-

Review Before Signing.

It is better to ask various questions if something is not clear. As a taxpayer, you should feel comfortable with the accuracy of your return. Make sure you review all the details before you authorize your tax preparer to e-file your income tax return. After you sign the return, be sure to get a copy of the completed return.

-

Ensure the Preparer Signs and Includes Their PTIN.

Tax preparers must have a Preparer Tax Identification Number (PTIN). Paid preparers must sign returns and include their PTIN.

If you need additional information, contact us today at admin@fas-accountingsolutions.com or 832-437-0385.