The IRS may have re-introduced 1099-NEC, but this doesn’t mean that 1099-MISC is now gone.

Here’s your quick guide on how to differentiate these two similar, but different forms:

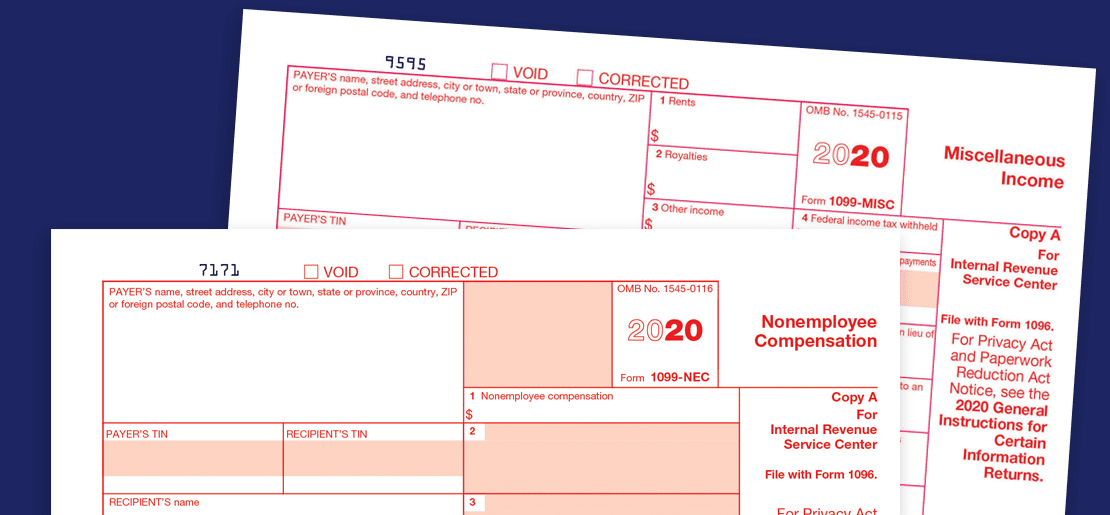

Form 1099-MISC

“MISC” stands for miscellaneous income so it is clear that this form has several uses. But starting tax year 2020, reporting of non-employee compensation has been completely removed from 1099-MISC. This form should now only be used to report payments for rents, royalties, prizes, medical/healthcare payment, backup withholding, etc. Form 1099-MISC will still be used and its deadline is still February 28 of the year after the tax year.

Don’t use Form 1099-MISC to report payments to:

- Employees; use Form W-2 for all types of payments to employees.

- Non-employees (with some exceptions)

- Corporations (with some exceptions)

- Pay for merchandise, telegraphs, telephone, freight, storage, and other similar items

Form 1099-NEC

Beginning with the 2020 tax year, the IRS will require business taxpayers to report non-employee compensation on the new Form 1099-NEC instead of on Form 1099-MISC. Businesses will need to use this form if they made payments totaling $600 or more to a non-employee, such as an independent contractor. The deadline for this form is on January 31st of the year after the tax year.

To learn more about 1099-NEC, read our blog discussing what the form is, who needs to file, why it was reintroduced, and when, where, and how to file it: Five ‘Ws’ and One ‘H’ of IRS FORM 1099-NEC

While both forms look similar, you have to keep in mind their different uses and deadlines. This is something new this 2020 so make sure you keep on top of your tax knowledge to avoid misfiling and receive unnecessary penalties.

If you need help with your 1099-NEC or other tax forms, let our Enrolled Agent help you! Contact us today at admin@fas-accountingsolutions.com or 713-855-8035.