Stay Informed, Stay Ahead:

Read our Financial & Tax Insights Blog

Blogs

DISCLAIMER: Any bookkeeping, business or tax article contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor can it be used to avoid tax-related penalties. If desired, we would be pleased to perform the requisite research and provide you with a detailed written analysis. Such an engagement may be the subject of a separate engagement letter that would define the scope and limits of the desired consultation services.

The Internal Revenue Service today announced its annual “Dirty Dozen” list of tax scams with a special …

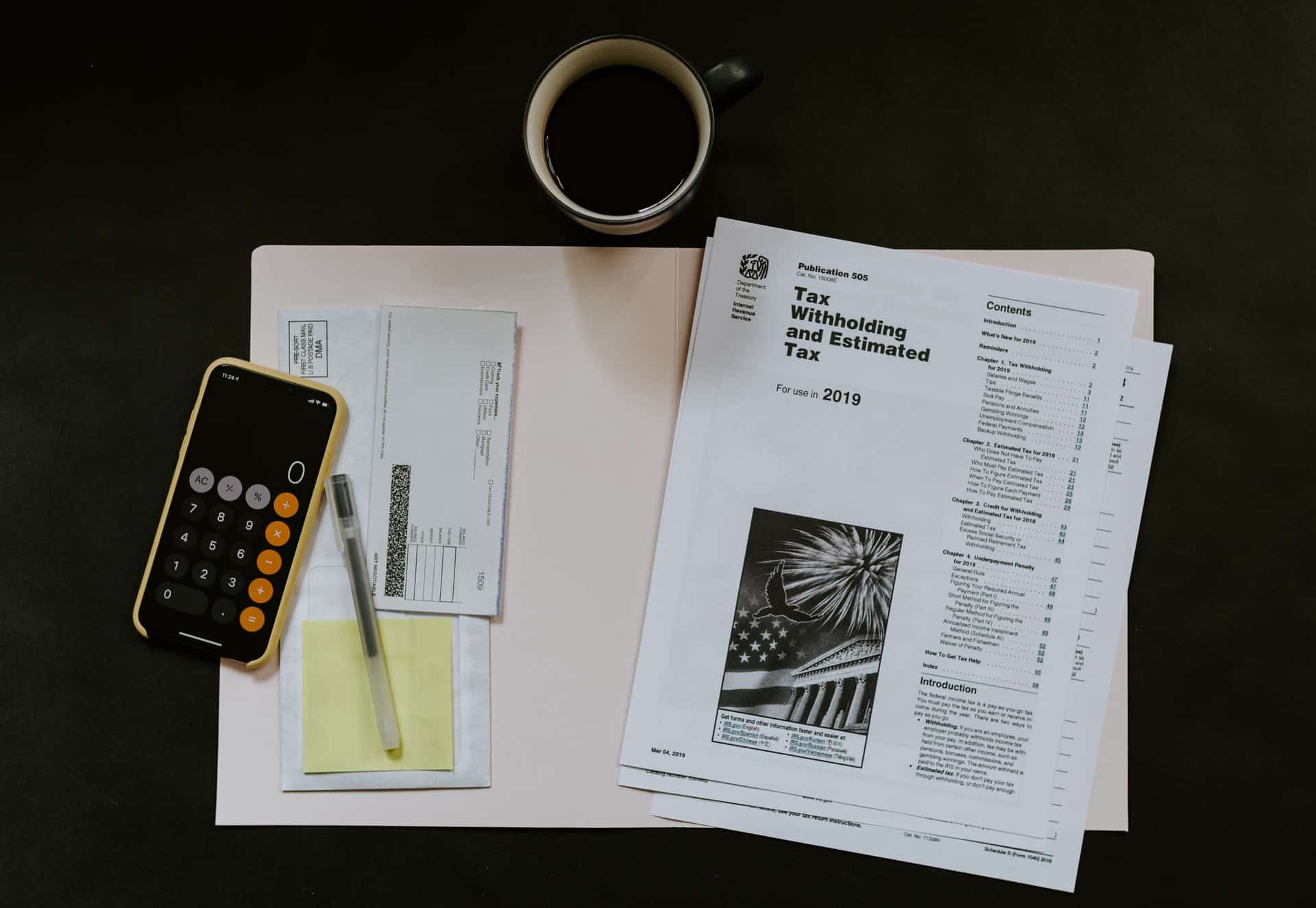

Federal law requires most employers to withhold federal taxes from their employees’ wages. Whether you’re a small …

If you discover a mistake on your tax return after you’ve already filed, don’t panic. In most …

Choosing the person that will help you with your business finances is a major life decision that …

While many schools are switching to hybrid or remote learning models, teachers and other educators should remember …

As such, it’s always a good idea to plan for what to do in case of a …

Many small businesses start strong – solid business plans, impressive products and services launches, adequate finances for …

Power Up Your Business Today!

CONNECT WITH US TODAY!

Address:

24044 Cinco Village Center Blvd #100

Katy, TX 77494

Phone:

(713)-855-8035

Email:

admin@fas-accountingsolutions.com

Sign up for our Newsletter

Let’s stay connected! You will receive updates straight to your inbox.