Stay Informed, Stay Ahead:

Read our Financial & Tax Insights Blog

Blogs

DISCLAIMER: Any bookkeeping, business or tax article contained in this communication, including attachments and enclosures, is not intended as a thorough, in-depth analysis of specific issues, nor a substitute for a formal opinion, nor can it be used to avoid tax-related penalties. If desired, we would be pleased to perform the requisite research and provide you with a detailed written analysis. Such an engagement may be the subject of a separate engagement letter that would define the scope and limits of the desired consultation services.

Most people file a tax return because they have to, but even if you don’t, there are …

As a business owner, you always have a lot on your plate. There is no one in …

Although tax season usually starts in late January, this year, the tax filing season is delayed until …

Every year, it’s a sure bet that there will be changes to current tax law and this …

Starting January 1, 2021, the standard mileage rates for the use of a car, van, pickup, or …

Here are 3 tax things that you should know about when you are a Canadian citizen living …

Starting December 13, 2020, the IRS began masking sensitive data on business tax transcripts. Previously, only sensitive …

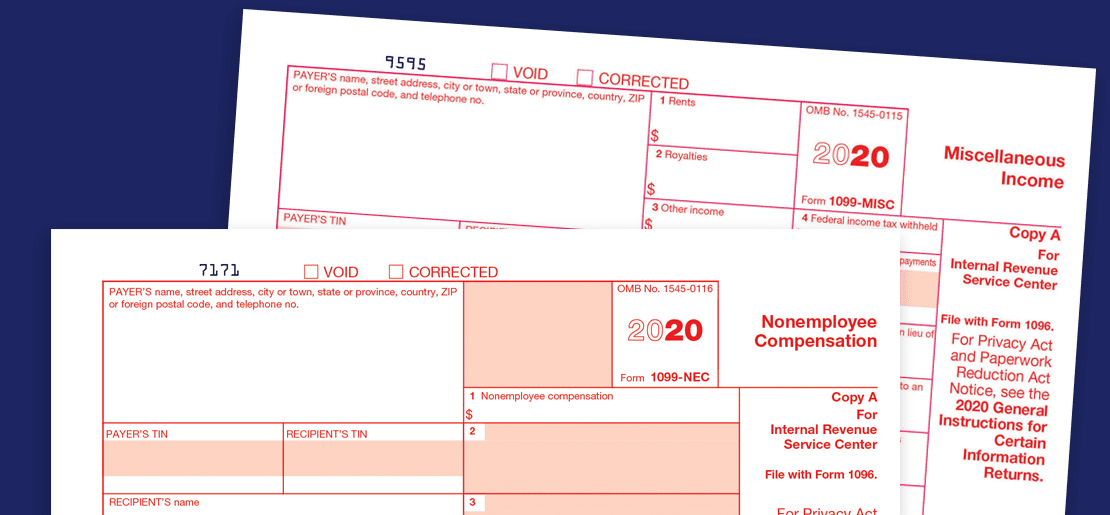

The IRS may have re-introduced 1099-NEC, but this doesn’t mean that 1099-MISC is now gone. Here’s your …

Prior to tax reform, an employee was able to deduct unreimbursed job expenses, along with certain other …

Power Up Your Business Today!

CONNECT WITH US TODAY!

Address:

24044 Cinco Village Center Blvd #100

Katy, TX 77494

Phone:

(713)-855-8035

Email:

admin@fas-accountingsolutions.com

Sign up for our Newsletter

Let’s stay connected! You will receive updates straight to your inbox.