STRUGGLING TO COLLECT INVOICES? TRY THESE 3 TIPS

No matter the size of your business, struggling to collect invoices can affect the financial performance of your business. This is especially true if the unpaid invoices are mounting and they outnumber those that are paid on time. Struggling to collect invoices means that your cash flow is affected. Interrupted cash flow due to uncollected invoices might result in a scenario where your business doesn’t have enough cash to pay its employees, suppliers, or vendors.

Here are 3 things that you can do to help deal with your struggle in collecting invoices:

-

Set a procedure and follow it

It is best practice to lay out a policy when it is to collect invoices. The policy might include details as to when will the invoice collection follow up occur and how often will the follow up occur if the initial attempt fell on deaf ears. The procedure to collect invoices might also include additional steps like double checking if you actually did send the invoice, if the payment terms were clear, if the amount due was clear, and if you sent it to the right company’s email address or mailing address.

Next, follow up politely as the procedure dictates. Keep in mind that sometimes uncollected invoices slip through the cracks. A client might be busy and forgot about the invoice, or the client might be out-of-town or dealing with an emergency. Follow up politely and keep your cool. Nobody likes receiving an angry email.

Avoid putting any ‘past due’ remarks on the invoice if the mistake was not deliberate. It will ensure that you’ll have a good working relationship with the client in the future if the uncollected invoice was just an honest oversight.

It is also a great idea to have someone help you keep track of your aging and uncollected invoices. Your bookkeeper would be the ideal person to be in charge of tracking your invoices. This way, any uncollected invoices will show up on your financial statements accurately.

-

Initial steps to collect unpaid invoices

Now that you have your internal procedure in place and you are adhering to it religiously. But your clients are still not getting back to you about the settlement of their unpaid invoices, you may proceed and do the initial steps that can help you collect invoices:

-

-

Resend invoice

-

Once the invoice becomes overdue, it is a good idea to send a polite and friendly follow-up email reminder to your client. Send it in a professional and courteous manner.

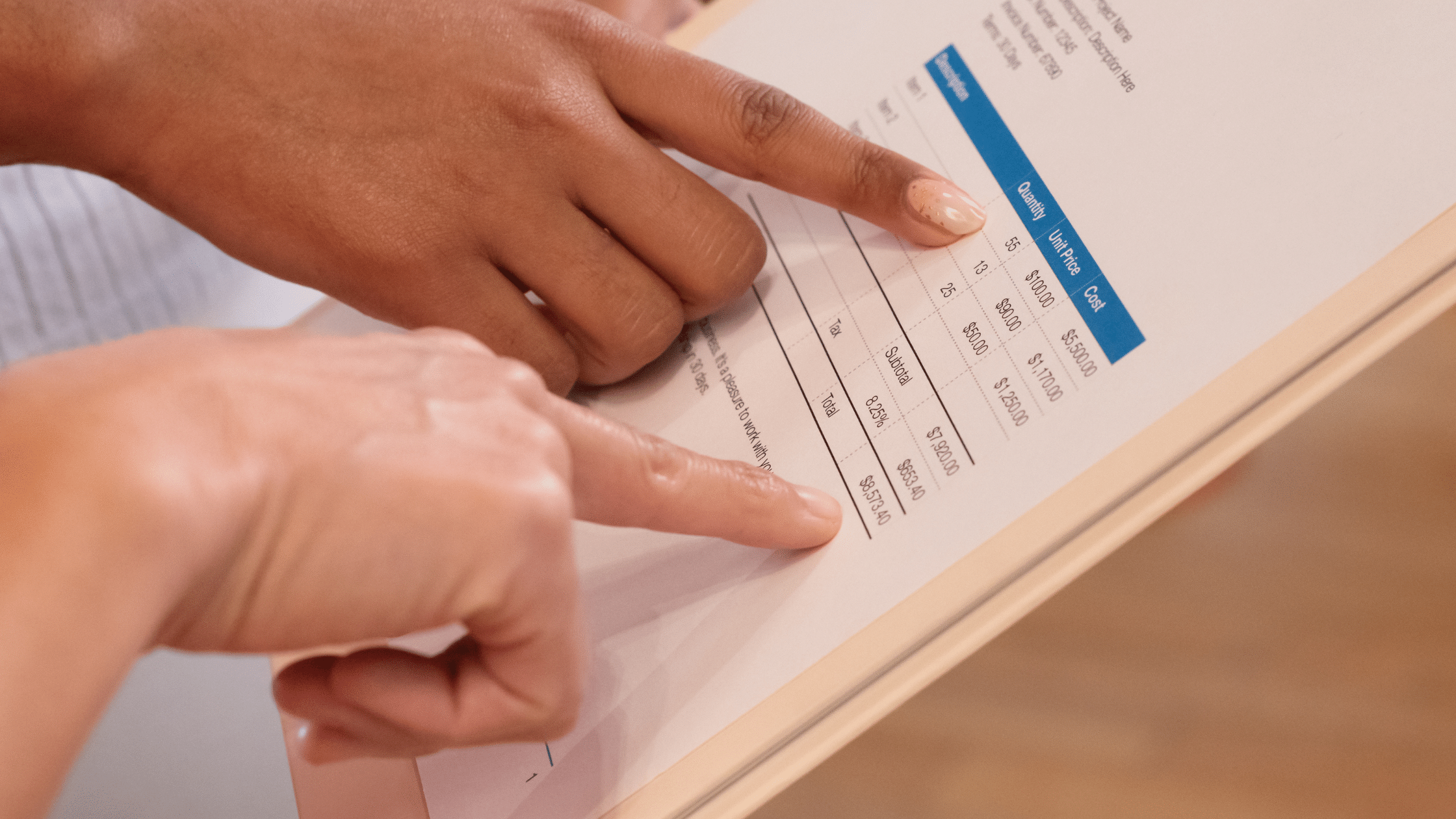

Inform them that their invoice is now past due and you are politely collecting their invoice. Include the payment due date and remind them of the available payment methods that they can use to settle their unpaid invoices. Clearly inform them of the late fees that might come with their unsettled invoice. Do not forget to include the original invoice in your follow-up email in order for the client to easily see it for reference.

-

-

Reach out

-

Emails sometimes get ignored or forgotten. If that’s the case for you, then it is a good idea to reach out to them by giving them a call or try asking if you can meet with them to discuss the matter. Now, if your initial contact does not respond to any of your communication attempts, you can try and contact their higher-ups to discuss the matter directly or you can give their billing department a direct call.

Most billing departments have access to all necessary information and they can let you know whether your reminders were received by them. If they inform you that they have already sent you the payment, you can ask for a rough estimate as to when will the payment arrive on your end.

-

-

Stop working with them immediately to avoid further losses

-

If you did all of the steps above and you still have not received a payment, stop working with them immediately. Inform them that you will not do any further work until they send the payment.

-

Get outside help

90 Days is a very long time for uncollected invoices. If your invoices are still not paid after all that time, it may be time for you to get serious outside help. Someone that can assist you in recovering the amount in the unpaid invoices. Here are some steps that you can take:

-

-

Hire a Collection Agency

Incessantly sending a follow-up email and cold calling your clients is hard work and it takes a lot of time. Consider hiring a collection agency to do that work for you so that you can focus on new projects that can generate income for your business to help its cash flow.

-

-

-

Send an attorney’s letter

Having an attorney draft a letter for you might be a good idea. You will still have to pay for the attorney’s letter but they usually cost reasonably. Appearing before the court might spur your client to get in touch with you immediately to work out a payment plan.

-

-

-

Small Claims Court

All 50 states have small claims courts that are designed specifically for use by non-lawyers. If the uncollected invoice is less than your state’s small claims court maximum limit, which is usually between $2,500 to $15,000, you can forego hiring a lawyer and represent yourself in court. There will be court fees, but at least you don’t have to pay those expensive attorney fees.

-

-

-

Arbitration

If the amount owed to you exceeds the maximum limit for a small claims court, you still can have another option. You can go through an arbitration board. Arbitration is quicker and cheaper than going to a higher court, but when it comes to an arbitration case, a judge won’t be hearing your case, an arbitrator will hear your case and will make the final judgment. The arbitrator’s decisions can be enforced in the same way a judge’s ruling can be.

-

-

-

Higher Court

If arbitration is not your cup of tea, you have the option to seek assistance from the higher courts if the amount owed to you exceeds the limit of the small claims court. But bear in mind that this option requires more of your time and will be more expensive since you can’t represent yourself in higher courts, you’ll need the services of a bona fide lawyer. Because of these factors, you should weigh in the pros and cons; will the amount that I might spend taking this matter to the higher court be worth it for the amount that I’ll be collecting?

-

Avoid uncollected invoices in the first place

If you want to mitigate the struggle of uncollected invoices in the first place, make sure to do a quick background check for new clients. Doing background checks can help you identify legitimate clients that do not have any prior complaints of non-payment in their history. After that, make sure that you have a signed contract. Keep detailed records, and ask for partial payment if you can’t ask for full payment.

You should also make the payment process as convenient as possible. Set up recurring invoices, and work on establishing strong client relationships.

Uncollected invoices can complicate your bookkeeping. Lucky for you we can help you with your bookkeeping!