The Crypto Rally

A few years back, cryptocurrencies and crypto trading was uncharted territory in the eyes of regulators. As people flock to cryptocurrency trading in hopes of quick and large gains; the IRS has set its eyes to lay down the law.

Early this year, Damon Rowe, director for the IRS’ Fraud Enforcement Office made an announcement at a Federal Bar Association presentation. The announcement was about the addition of key operational functions in its fraud enforcement priorities. This announcement hinted at the addition of a dedicated team of Criminal Investigation professionals who are working on what was dubbed as “Operation Hidden Treasure”. The task force in charge of the operation is comprised of agents who are trained in cryptocurrency and virtual currency tracking. According to Damon Rowe, the team will focus on taxpayers who omit cryptocurrency income from their tax reports. Operation Hidden Treasure is a joint effort between the civil office of fraud enforcement and the criminal investigation unit, they aim to root out tax evasion from cryptocurrency owners and traders.

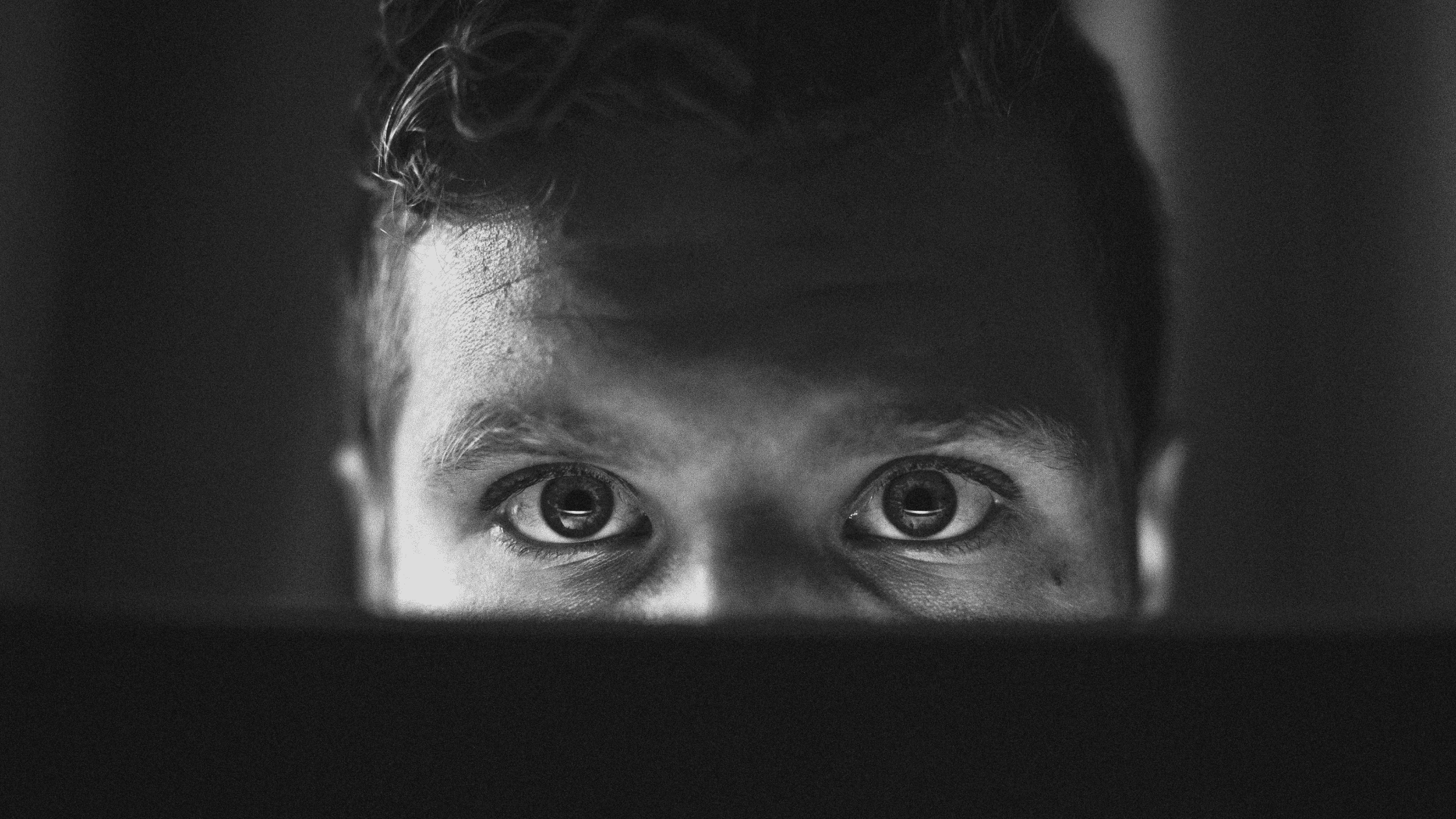

“WE SEE YOU”

That is the message that the National Fraud Counsel & Assistance Division Counsel for the Office of Chief Counsel; Carolyn Schenck, has to say for crypto traders who are would-be tax evaders. According to Schenck, the IRS is working on “how to get ahead of the game,” by looking for various “tax evasion signatures.” The signature that Schenck mentioned manifests itself in the form of transactions structured in a way that it flies under the radar of the IRS e.g., transactions in increments of $10,000 to avoid certain reporting requirements. This also includes the use of nominees, shell corporations, or getting on and off the chain, says Schenck.

Crypto trading gains reporting – What makes it criminal?

What makes the failure to report your cryptocurrency holding or trading gains on your tax reports a criminal act?

Criminal Tax Evasion is defined by I.R.C. section 7201 as:

“Any person who willfully attempts in any manner to evade or defeat any tax imposed by this title or the payment thereof shall, in addition to other penalties provided by law.”

What does that mean? It means that tax evasion must be willful, and willfulness is defined as an intentional violation of a known legal duty. Even though the IRS decides not to pursue criminal charges, the civil consequences for fraud are not exactly a walk in the part. A penalty of 75% of the understatement of the tax is applied.

Coming Clean?

The tax defense bar asked the IRS to announce some type of voluntary disclosure program, similar to that of the foreign bank disclosure program that could let virtual currency holders to “come clean” for years, to no avail. However, the IRS is yet to show some inkling if they will or will not roll out such a program.

Including your crypto trading gains in your next tax report can be quite confusing. But it doesn’t have to be! Lucky for you we can help you out!

Get in touch with us today and we’ll sort things out!